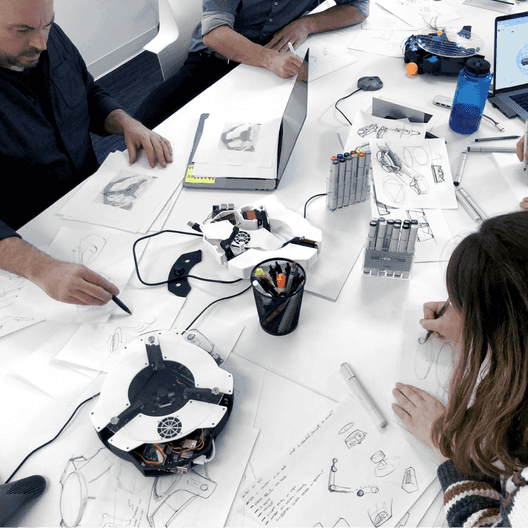

Driven, passionate,

and looking for more

Spanning a variety of industries, our founders and management-owners have a few things in common: they've all built something special, have a successful track record, and are eager to take their business to the next level.

Companies and partnerships described herein do not represent all investment decisions made by Cynosure. The reader should not assume that investment decisions identified and discussed were or will be profitable. Specific investment references provided herein are for illustrative purposes only and are not necessarily representative of investments that will be made in the future.

The information provided on this website is for informational purposes only and should not be construed as investment advice, a recommendation, or an offer to sell or solicitation of an offer to purchase any security. Certain statements contained herein may include forward-looking statements regarding future events or the future performance of portfolio companies; such statements are inherently uncertain, subject to change, and may not be realized. References to market opportunities, management objectives, or strategic initiatives reflect the views of Cynosure or the portfolio company’s management as of the date made and are not guarantees of future outcomes. Past performance of Cynosure, its investments, or any portfolio company is not indicative of future results. All information is provided “as of” the date referenced and is subject to change without notice